Are you dreaming of owning your perfect home but encountering obstacles in the traditional financing system? A low doc loan could be your key to making that dream a reality.

These loans are tailored for individuals who may have the typical documentation required by traditional lenders. Due to you're self-employed, have a diverse income source, or simply prefer a simpler application process, low doc loans can offer adaptability.

With a low doc loan, you can often secure funding faster and with less paperwork, allowing you to transition into your dream home sooner.

Resist let the typical financing process hold you back any longer. Explore the benefits of a low doc loan and discover how it can open the door to your dream home.

Get Approved Faster : The Power of Low Doc Mortgages

Securing a mortgage can often be a arduous process. But what if there was a way to significantly shorten that journey? Enter low doc mortgages, a convenient financing option designed to make the qualification process smoother and faster for borrowers who may not have all the traditional documentation required.

These progressive loans depend less on extensive financial records and more on your ongoing financial circumstances.

This means you can often get approved faster, giving you the Low Doc Mortgage opportunity to purchase your dream home without unnecessary wait times.

Low doc mortgages offer a compelling solution for borrowers who:

* Havescarce financial history.

* Are self-employed or have irregular income streams.

* Require rapid financing solution.

Discover the potential of low doc mortgages today and see how they can help you obtain your homeownership goals with efficiency.

Accessing Your Dream Home: Low Doc Mortgage Lenders

Low documentation mortgages offer a streamlined route to homeownership for those who might encounter difficulties with traditional financing methods. These lenders focus on your ability to repay rather than demanding extensive documentation. If you're a freelancer, have limited credit history, low doc mortgages could be your key.

- Research lenders who specialize in low documentation loans.

- Gather the necessary financial information to demonstrate your ability to repay.

- Shop around interest rates and terms from different lenders.

Don't let complexities stand in the way of your homeownership goals. With low doc mortgage lenders, you can streamline the financing process and make a reality your dream of owning a home.

Optimize Your Finances: Low Doc Home Refinance Options

Lowering your monthly expenses can make a big impact in your finances. If you're looking to decrease your mortgage obligation, a low doc home refinance might be the perfect solution for you. These solutions are designed for borrowers who may not have traditional documentation, such as recent tax returns or pay stubs. With a low doc refinance, you can often be approved for a advantageous interest rate and restructure your loan terms to match your needs.

This type of refinance is a great way to combine debt, obtain cash equity for home improvements or other expenses, or simply decrease your monthly payments.

To find the best low doc refinance program for you, it's important to shop with multiple lenders and carefully review the terms and conditions before making a decision.

Need a Home Loan? Explore Their Low Doc Solutions

Purchasing a dream home shouldn't be hindered by paperwork. If you're facing challenges with traditional loan documentation, explore our flexible Low Doc solutions. We understand that everyone's financial situation is unique, and we strive to make the homeownership process as smooth as possible.

- Our streamlined application process requires minimal documentation, allowing you to qualify for a loan rapidly.

- We offer competitive interest rates and flexible repayment options to suit his individual needs.

- With our expert guidance, you can navigate the complexities of home financing with ease and confidence.

Contact us today for a free consultation and let our team help you achieve your homeownership goals.

Low Doc Mortgage Options Explained: Fast Approvals, Flexible Requirements

Are you seeking a new home but facing traditional mortgage hurdles? Consider low doc mortgages! These innovative mortgage products simplify the process by offering quicker approvals and adaptable requirements. Whether you're a freelancer, or simply need, low doc mortgages can provide the opportunity to your dream home.

Unlike conventional mortgages, low doc loans often necessitate less financial records. This means you can obtain a loan faster and with simplified procedures.

- Let's explore the key advantages of low doc mortgages:

- Fast approval times: You can receive a mortgage decision within a week.

- Flexible documentation requirements: Your income sources are considered more accommodatingly

- Simplified application process: The application is often streamlined for faster processing

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Amanda Bearse Then & Now!

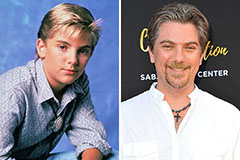

Amanda Bearse Then & Now! Jeremy Miller Then & Now!

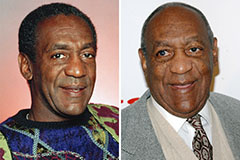

Jeremy Miller Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!